This is an old revision of the document!

Table of Contents

Free Trade - A Wealth vs. Energy Model

As an experiment for a video, I devised a computer simulation of the free trade of wealth and energy using NetLogo's free Agent-Based Modelling (ABM) software. You can view an interactive model online or download the NetLogo source code. (A copy of this model also exists in the NetLogo media commons)

Summary

The goal was to create as fair a simulation as possible of a free market trading economy using a few simple parameters. These are:

- Each agent would start with the same amount of wealth and energy. (Capital)

- Each agent would be given a randomly applied 'skill' attribute (a number of varying value, constrained to a maximum of double the lowest)

- Each agent would trade with a fixed number of randomly allocated 'customer' agents

- A 'trade' would consist of selling 1 copy of their skill as energy, divided out and paid for equally among their customers

- Every trade would expend 1 unit of an agent's energy (regardless of value)

- There is always the same amount of money in the system

Notable omissions from the model

In order to keep things simple, it was necessary to omit some aspects of real society that I felt would not make a dramatic difference in the outcome. These are:

- No generations (births, deaths, etc) It's safe to assume that the majority of held wealth would follow bloodline anyway

- No marriages / pairing of agents. Though this would affect wealth distribution in some cases, this is outside the scope of this model

- No inheritance, title or privilege (or lack of). To make it as fair as possible, everyone starts with the same financial opportunity

- No resource extraction. The limits of physical resources are not relevant to this model

- No overconsumption or waste. Not relevant to this model

- No debt / negative money. Though obviously an important factor in real society, it's outside the scope of this model

- No enhanced powers on wealth acquisition. (Possessing wealth does not make it easier to earn more)

- What comprises 'skills' for making money is not relevant to the model. There are no ethics

Observations

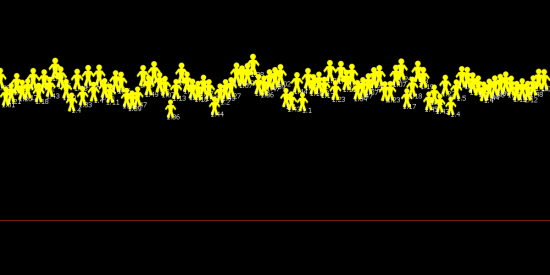

Initially running the model with agents set at the same minimum skill level reveals no significant increase or decrease in wealth.

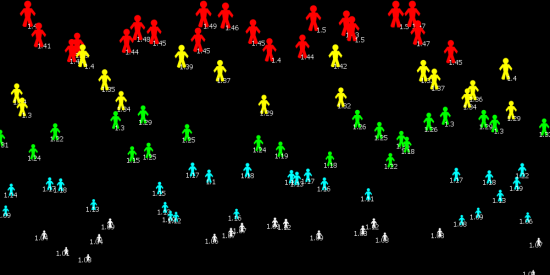

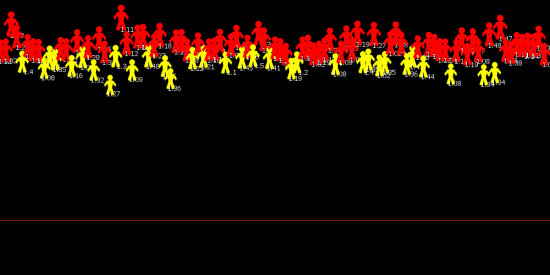

Even running the model with conservative values (say 1.5 skill variance) reveals a strong and fast trend of the rich getting richer and the poor getting poorer.

Also, while running for a while, we see the 'middle classes' getting completely wiped out and almost all wealth gravitating to the richest 10%.

Also it should be noted that there is no debt and only those who can 'afford' to pay are selected as customers at each cycle, however these 'poor' agents can still sell their skills as per normal. Also, it should be further noted that no amount of extra wealth or energy enhances any agent's ability to sell their skills.

Safety net

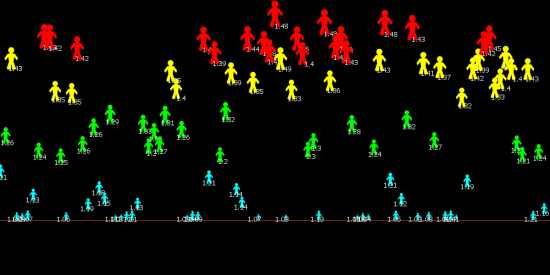

Since the model effectively 'kills' off poor agents without mercy, I decided to add a 'safety net' feature which would roughly mimic the effect of social safety nets like state welfare, charity or microloans. Once an agent is in danger of falling below this 'poverty' threshold, they are awarded an extra wealth credit freely. This credit is then taxed across all other agents equally.

While this is an effective way to rescue agents from the poverty line, it makes little difference to the trend of the rich getting richer, except slowing it slightly.

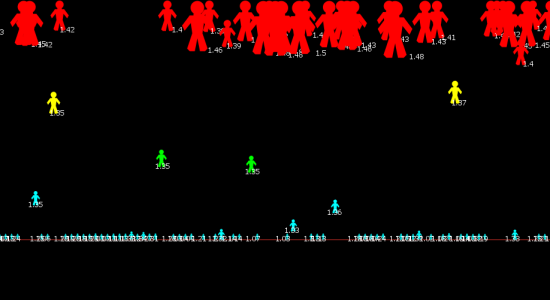

The transfer of energy

In this model, 'energy' generally refers to work effort and quality of life. ie. Agents 'spend' energy selling their product, and 'consume' energy that they purchase from other agents as quality of life. The greater the energy they have, the higher is their quality of life.

Tracking energy instead of wealth reveals a completely different distribution where all agents are in the ascendancy.

Even though some agents are 'selling' more energy than others, the net effect is that the net increase in energy across the population is roughly evenly distributed.