This is an old revision of the document!

Table of Contents

Free Trade - A Wealth vs. Energy Model

As an experiment for a video, I devised a computer simulation of the free trade of wealth and energy using NetLogo's free Agent-Based Modelling (ABM) software.

You can view an interactive model online or download the NetLogo source code. (A copy of this model also exists in the NetLogo media commons)

Summary

The goal was to create as fair a simulation as possible of the evolution of a free market trading economy using a few simple parameters, and compare how the transfer of wealth related to the transfer of 'energy' - denoting work or quality of life.

A model 'world' is created and populated with agents who follow a simple set of rules. These are:

- Each agent starts with the same amount of wealth and energy. (Capital)

- Each agent is given a randomly applied 'skill' attribute (a number of varying value, constrained to a maximum of double the lowest)

- Each agent trades with the same fixed number of customer agents, randomly allocated at each cycle

- A 'trade' consists of selling 1 copy of their skill as energy, divided out and paid for equally among their customers

- Every trade costs 1 unit of an agent's energy (regardless of value)

- There is always the same amount of money in the system

Notable omissions from the model

In order to keep things simple, it was necessary to omit some aspects of real society that I felt would not make a dramatic difference in the outcome. These are:

- No generations (births, deaths, etc) It's safe to assume that the majority of held wealth would follow bloodline anyway

- No marriages / pairing of agents. Though this would affect wealth distribution in some cases, this is outside the scope of this model

- No inheritance, title or privilege (or lack of). To make it as fair as possible, everyone starts with the same financial opportunity

- No resource extraction. The limits of physical resources are not relevant to this model

- No overconsumption or waste. Not relevant to this model

- No debt / negative money. Though obviously an important factor in real society, it's outside the scope of this model

- No enhanced powers on wealth acquisition. (Possessing wealth does not make it easier to earn more)

- What comprises 'skills' for making money is not relevant to the model. There are no ethics

Observations

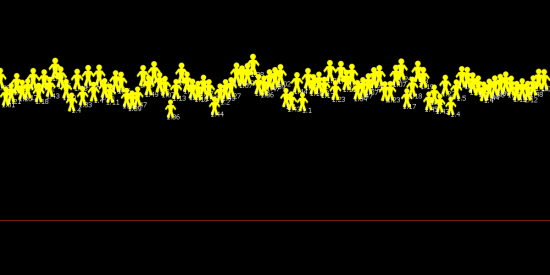

Initially running the model with agents set at the same minimum skill level reveals no significant increase or decrease in wealth.

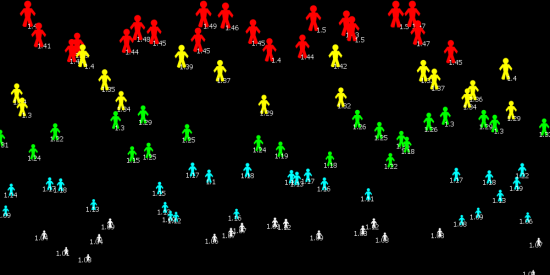

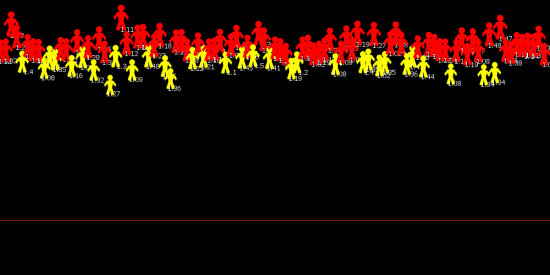

Even running the model with conservative values (say 1.5 skill variance) reveals a strong and fast trend of the rich getting richer and the poor getting poorer.

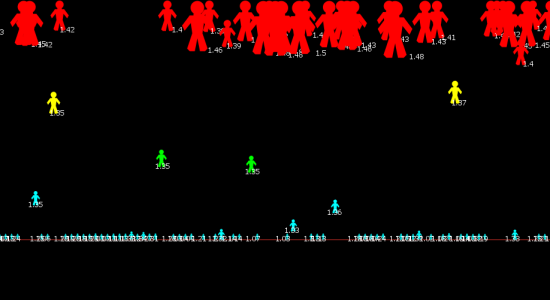

Also, while running for a while, we see the 'middle classes' getting completely wiped out and almost all wealth gravitating to the richest 10%.

Also it should be noted that there is no debt and only those who can 'afford' to pay are selected as customers at each cycle, however these 'poor' agents can still sell their skills as per normal. Also, it should be further noted that no amount of extra wealth or energy enhances any agent's ability to sell their skills.

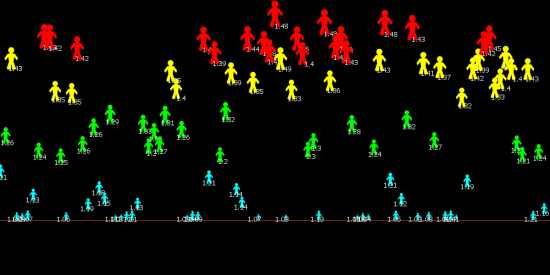

Safety net

Since the model effectively 'kills' off poorer agents, I decided to add a 'safety net' feature which would roughly mimic the effect of social safety nets like state welfare, charity or microloans. Once an agent is in danger of falling below this 'poverty' threshold, they are awarded an extra wealth credit freely. This credit is then taxed across all other agents equally.

While this is an effective way to rescue agents from the poverty line, it makes little difference to the trend of the rich getting richer, except slowing it slightly. (NOTE: A higher safety net figure could be used to simulate a universal basic income)

The transfer of energy

In this model, wealth and energy are tracked independently. 'Energy' generally refers to work / effort and quality of life. ie. Agents 'spend' energy selling their product, and 'consume' energy that they purchase from other agents as quality of life.The greater the energy they have, the higher is their quality of life.

In this simulation, all agents spend exactly 1 unit of energy 'selling' their product regardless of price. This would appear to be a fair reflection of the similar amount of effort it requires to put in a day's work regardless of salary.

Tracking energy instead of wealth reveals a completely different distribution where all agents are in the ascendancy.

Even though some agents are 'selling' more energy than others, the net effect is that the net increase in energy across the population is roughly evenly distributed.

Conclusions

Even though quality of life generally increases for all agents, there is a significant cost in terms of inequality and the suction of wealth from society by the wealthy. And it's worth emphasising that there are no greed or privilege elements in this model; the gravitation of wealth to the wealthy is simply a mathematical function of their costs becoming proportionally less and less.

When both the transfers of wealth and energy are taken equally into consideration the net benefit to society is only marginal, whereas a society that was hypoethetically based on the transfer of energy only (open access) would be significantly before off.

— Colin R. Turner 2021/03/21 20:14—